38+ 12 year fixed rate mortgage calculator

But you may also obtain 20-year 15-year and 10-year terms. After that five-year period if you do not remortgage your loan will automatically revert to the lenders standard SVR.

Xuabsf2xh84 Vm

Solar energy capacity increased by 17 in 2007 reaching the total equivalent of 8775 megawatts MW.

. Minimum monthly payments on these loans depend on external factors and opting for. Fixed-Rate Mortgage FRM Rate APR 10-year. The following chart shows average mortgage rates for different fixed-rate terms as of January 12 2021.

A home equity loan commonly referred to as a lump sum is granted for the full amount at the time of loan origination. Solar energy deployment increased at a record pace in the United States and throughout the world in 2008 according to industry reports. This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds 2700000Also the maximum section 179 expense deduction for sport utility vehicles placed in service in tax years beginning.

Since extended terms take. The 15-year fixed-rate mortgage is the second most popular home loan choice among Americans with 6 of borrowers choosing a 15-year loan term. As long as you make consistent payments your debt should be paid off within 30 years.

After years of making regular payments the amount paid in interest begins to stack up and can become one of the more burdensome costs associated with mortgages. Between January 2012 to 2017 the average rate ranged between 334 percent to 453 percent. Find average mortgage rates for the 30 year fha fixed mortgage from Mortgage News Daily and the Mortgage Bankers Associations rate surveys.

For a 30-year fixed mortgage with a 35 interest rate you would be looking at a 1437 monthly payment. If someone starts out their career making 78k per year and after 12 years are making 178k per year and during that entire time are saving 40 of their income your model states they could retire after 22 years on 60 of 178k. Please keep in mind that the exact cost and monthly payment for your mortgage will vary depending its length and terms.

Across the United States 88 of home buyers finance their purchases with a mortgage. Section 179 deduction dollar limits. Fixed-Rate Mortgages FRM Historically the most widely purchased type of loan is a 30-year fixed-rate mortgage.

To get an amortization schedule for your 15-year fixed-rate mortgage use the calculator on top of this page. It increased to 509 percent in 2010 but went down to 477 percent in 2011. For example a 100000 30-year fixed mortgage might come with an interest rate of 3 requiring the borrower to pay an additional 3 on top of their principal loan balance.

Todays national mortgage rate trends. Mortgage interest rates are always changing and there are a lot of factors that. Interest rates on such loans are fixed for the entire loan term both of which are determined when the second mortgage is initially granted.

Thinking of getting a 30-year variable rate loan with a 10-year introductory fixed rate. They texted pretty much every day but Whitney had called to make a case for why her friend should fly up to New York City from Atlanta where she lived with her husband and teenage daughter to attend their 25th reunion. The average interest rate for the most popular 30-year fixed mortgage is 548 according to data from SP Global.

Fixed Rate Home Loan Principal and Interest 1 Year LVR 80 Low rate home loan with added benefits add offset for 010. This is regardless of whether index rates rise or fall. Fixed Rate Mortgage Loan Calculator.

The 15-year fixed-rate mortgage is the second most popular home loan choice among Americans with 6 of borrowers choosing a 15-year loan term. For instance you purchased a house with an introductory 5-year fixed rate at 269 APR. 10YR Adjustable Rate Mortgage Calculator.

As for payment terms the most common ones are 30-year terms. The math may be too simple. Housing market 15-year fixed mortgages are the second most popular loan product next to 30-year fixed-rate loans.

For example if you took a 30-year fixed-rate loan your payments will not change for the next 30 years. Is the number of payments. This model assumes an individual is making the same amount every year.

Solar Industry Year in Review found that US. For tax years beginning in 2022 the maximum section 179 expense deduction is 1080000. 10 Year Fixed Rate Mortgage Calculator.

Mortgages come in two main payment structures. The MND Rate Index is the best way to follow day-to-day movement in mortgage rates. Across the United States 88 of home buyers finance their purchases with a mortgage.

For today Tuesday September 13 2022 the current average 30-year fixed-mortgage rate is 610 rising 8 basis points compared to this time last week. The Solar Energy Industries Associations 2008 US. A 15-year fixed-rate mortgage comes with a monthly payment and interest rate that does not change for 15 years.

The aim of remortgaging is to secure a better deal than your lenders SVR reversion rate when the introductory period expires. Where the most common type is the 30-year fixed-rate. For monthly payments over 30 years 12 months x 30 years 360.

The most common mortgage in Canada is the five-year fixed-rate closed mortgage as opposed to the US. Of those people who finance a purchase nearly 90 of them opt for a 30-year fixed rate loan. 8822 lifetime cap 381.

In January 2009 the average 30-year fixed mortgage rate dropped by 106 percentage points from 2008. Second mortgages come in two main forms home equity loans and home equity lines of credit. Yes your mortgage payments are kept the same throughout the loan.

Its used as a loan purchasing tool and is also a popular refinancing product for borrowers. Save thousands. Use this calculator to figure your expected initial monthly payments the expected payments after the loans reset period.

Of those people who finance a purchase nearly 90 of them opt for a 30-year fixed rate loan. Fixed-rate mortgages FRM and adjustable-rate mortgages ARM. This is typically generated by an amortization calculator using the following formula.

On the other hand lenders assign the highest rates to 30-year FRMs. The SEIA report tallies all types of. Assuming you have a 20 down payment 80000 your total mortgage on a 400000 home would be 320000.

Unlike a 30-year fixed rate mortgage adjustable rate mortgages ARMs come with a fluctuating interest rate that rises or lowers along with market conditions. Second mortgage types Lump sum. The two had been close friends since they met their first year at Columbia Business School.

70 Of Investors Expect A 075 Rate Hike In September By Michalis Efthymiou - Sep 05 2022 Today is a bank holiday for the US and Canada. While most homebuyers choose a 30-year fixed mortgage 15-year fixed mortgages allow you to pay for your loan in half the time. Unlike mortgage rate surveys our index is driven by real-time changes in actual lender rate sheets.

Get a 70 star NatHERS rating or higher for up to 159 discount on your variable rate home loan TCs apply.

Free 38 Sheet Samples Templates In Pdf

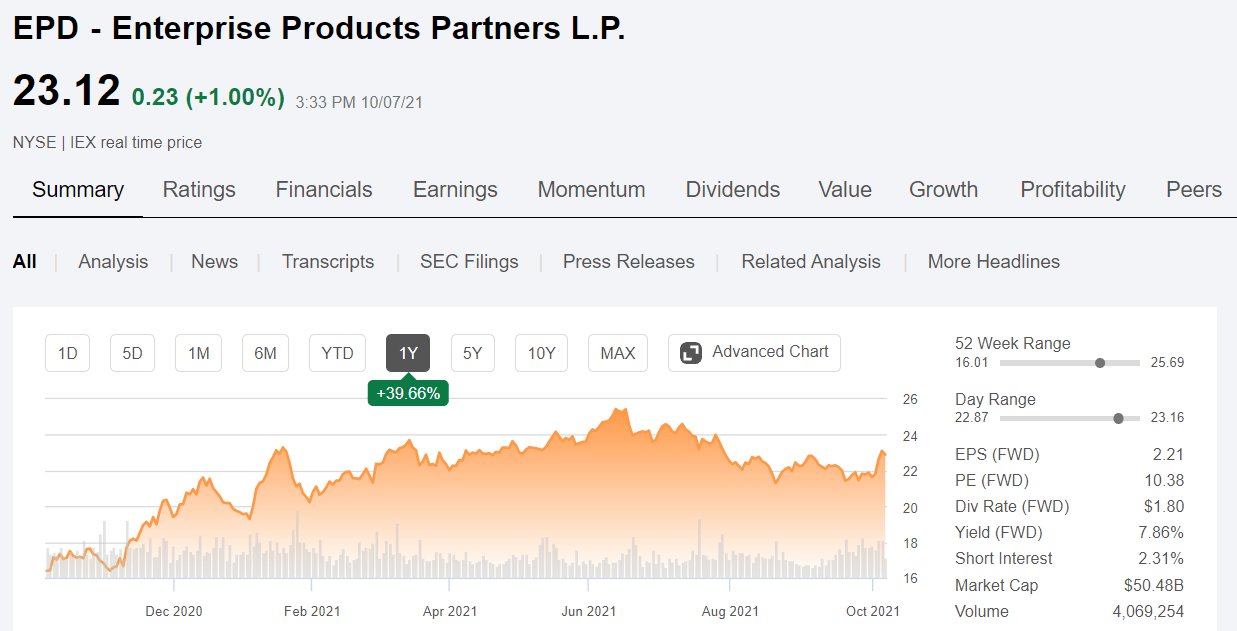

Enterprise Products Partners Stock Compelling Value Nyse Epd Seeking Alpha

38 Creative Patio Garden Floor Decorating Ideas With Patterns For 2022 Landscaping With Rocks Garden Floor River Rock Landscaping

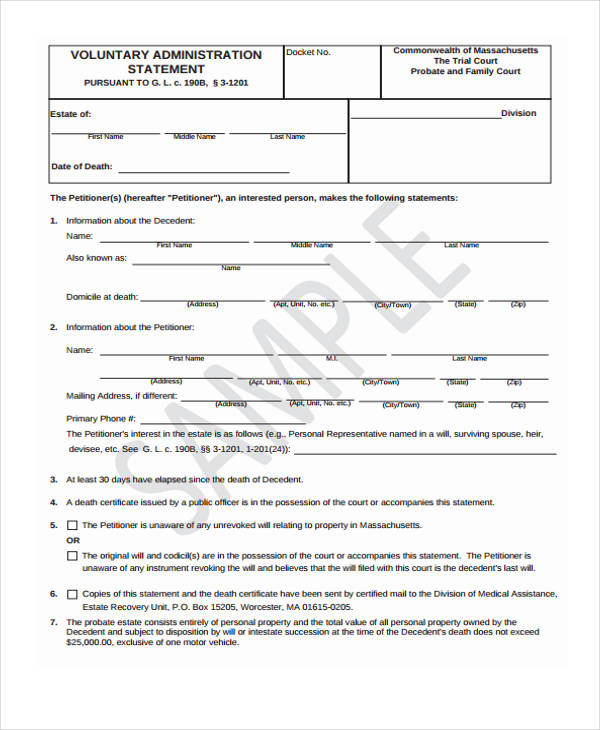

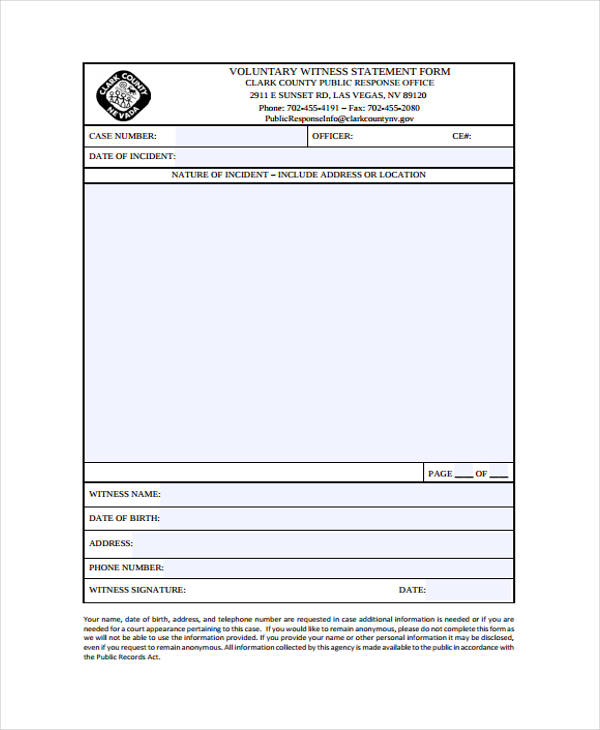

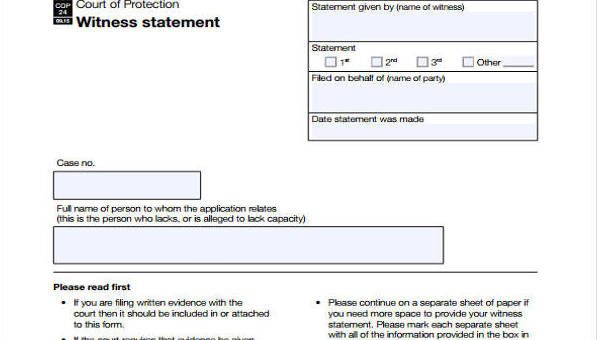

Free 38 Example Of Statement Forms In Pdf Excel Ms Word

Free 10 Balance Sheet Samples Templates In Ms Word Ms Excel Pdf

G64421mmi038 Jpg

Free 9 Loan Spreadsheet Samples And Templates In Excel

Free 38 Example Of Statement Forms In Pdf Excel Ms Word

Free 38 Samples Of Statement Templates In Pdf Ms Word

Free 38 Samples Of Statement Templates In Pdf Ms Word

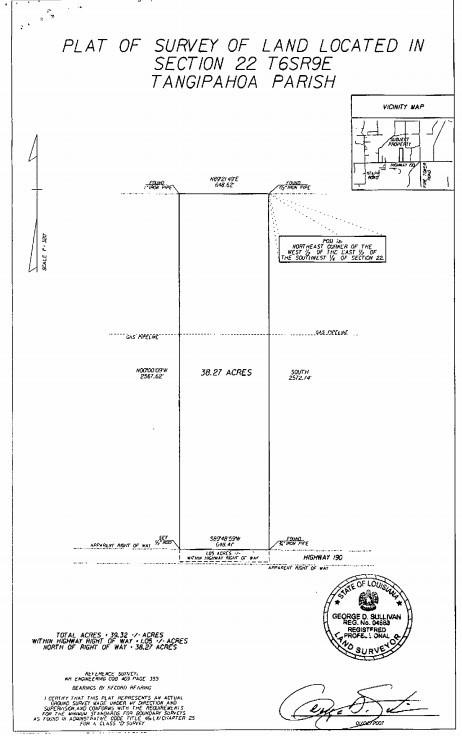

Tbd Hwy 190 E Highway Robert La 70455 Compass

Free 10 Balance Sheet Samples Templates In Ms Word Ms Excel Pdf

G64421mmi057 Jpg

Free 38 Example Of Statement Forms In Pdf Excel Ms Word

Pin On Bedroom Decor

Screen Printing Machine Products 38 Ideas Instagram Highlight Icons Instagram Icons Instagram Story

G64421mmi016 Jpg